Overview

Loan Central was the product of a 2-week design sprint by my team mate, Samuel, and me. Two main goals underlie the main features of this financial loan mobile app:

1. To reduce the occurrences of scams

2. To help borrowers to manage their loan applications and repayments better

Timeline

2 weeks (May 2021)

Methods

Contextual Inquiry, User Interviews, Affinity Mapping, Wireframes, Prototyping, Usability Testing

My Role

- Co-led Market and User Research

- Refined User Personas and Problem Statement

- Created Design System

- Designed Wireframes and Prototypes

- Conducted Usability Testing

Background

Do these SMSes look familiar to you? Ever received unsolicited financial loan messages from unknown sources that are disguised as licensed moneylenders?

With the world in a pandemic and businesses across Singapore being impacted by COVID-19, unlicensed moneylending has been thriving more than ever. This has resulted in an increase in the number of Singaporeans who actually fall prey to such scams.

The amount of money cheated from loan scams reported in 2020 hit a record high of $14.5m, an increment of $7.7m from 2019. *

Short of bringing vigilante justice upon those behind these illegal schemes, we decided to come up with a mobile platform that funnels borrowers towards taking out loans from licensed moneylenders.

* Jean L. (2021, Feb 9). 'Record number of scams in 2020 pushed overall crime rate in S'pore to highest in more than 10 years'. The Straits Times. https://www.straitstimes.com/singapore/courts-crime/record-number-of-scams-in-2020-pushed-overall-crime-rate-in-spore-to-highest

The Challenge

Borrowers are often impatient yet skeptical when it comes to moneylending. They need a streamlined process for licensed loan application and management because they find the current process tedious and are cautious of getting cheated.

The Solution

It is important to note that Loan Central neither promotes nor encourages moneylending. Rather, it aims to be the one-stop solution to help borrowers in need of money identify licensed moneylenders, while at the same time provide them with a clear process to apply and manage their loans.

To make this possible, we decided to focus on 3 areas for our design.

1

Establish credibility

Prominently display affiliations with relevant government authorities and reputable financial institutions

Indicate moneylender's license number, ratings and reviews for users' assurance

2

Reduced Touch Points

Efficient one-time application to multiple licensed moneylenders with the option to fill in loan application via Singpass

Quick links on home screen to serve as shortcuts to key features

3

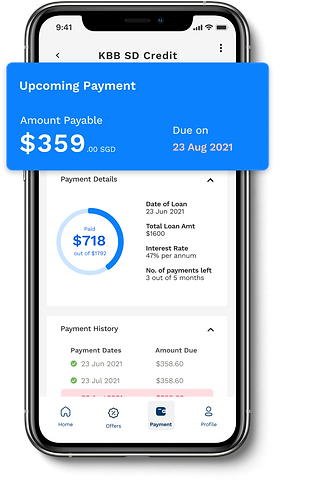

Clear Visualisation

Graphical representation for calculation of loans

.png)

Details information on loan repayment cycle with timely reminders

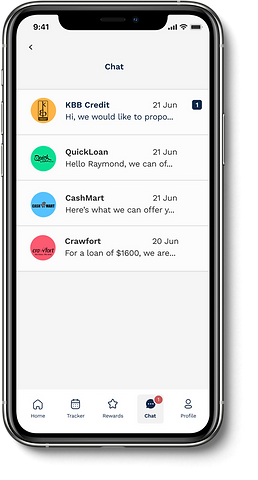

Comparison of offers at one glance

RESEARCH

Demystifying the Unknown

Here are the various research methods we used to gain deeper understanding of the moneylending landscape in Singapore:

Emailing relevant Government Agencies

Contextual Inquiry

Competitive Analysis

User Interviews

Contextual Inquiry

We reached out to some moneylenders and was given the opportunity to interview the moneylenders in context of their work while they perform real tasks and to observe how moneylending works. This allowed us to better understand the regulations and requirements that applies to moneylending and how the processes work throughout the lending to repayment stages.

Emailing relevant Government Agencies

Understanding that there is a slew of regulations when it comes to licensed moneylending in Singapore, we began our research by emailing government bodies (Ministry of Law and Credit Association of Singapore) to address our concerns and to ascertain our idea of designing a mobile app is feasible.

What we found out was that in fact there are a few moneylenders with their own developed apps. However, there is more to be explored in terms of building a centralised moneylending platform to connect loan applicants to licensed moneylenders.

Competitive Analysis

We also examined 3 competitors in the finance industry to identify what they have done well, thus informing our design decisions. From our analysis, we gathered 4 main learning points.

1

2

3

4

Usage of charts to help users visualise the calculation for loan repayments

Quick links to serve as shortcuts to key features

Filling lengthy application form with a single touchpoint (Singpass)

Clear step by step guidance on loan application process

Users are afraid of being scammed by unlicensed moneylenders

Users find it inconvenient and repetitive to visit multiple moneylenders to gather quotes

Users need a way to gauge repayment amount based on loan and tenure

Users want best deal/ lowest interest rate loan

User Interviews

We conducted 10 user interviews with current and potential borrowers, aged 25 to 60. We sought to learn their behaviours, motivations and frustrations when it comes to borrowing money from moneylenders in Singapore. From the interviews, we uncovered a few key insights.

1

2

3

4

PERSONAS

Who's the User

Ah Huat, 53

Taxi Driver

SCENARIO

Ah Huat is the sole breadwinner of his family. His daughter is sick and he has been borrowing money from multiple lenders to foot her medical bills. One thing that really annoys Ah Huat is that he has to go down to the different money lenders to apply for loans only to get rejected.

BEHAVIOUR

• Busy and time conscious

• Spends most of his free time looking after his daughter in the hospital

NEEDS

• Find out his eligibility for loans before making a trip to the moneylender

• A simple online loan application process

FRUSTRATIONS

• Futile trips to the moneylenders

• Incur late fees as there are no timely reminders to help him track his loan repayments

Nurhani, 28

Sales Executive

SCENARIO

Nurhani bought a flat with her husband and they are intending to apply financial loan for her home renovation. However, Nurhani is skeptical of doing so as she is unsure of how to ascertain whether the lender is licensed. Her fear stems from her having heard a lot of news about people being cheated of their savings from unlicensed moneylenders (more commonly known as “Ah Long” or Loansharks).

BEHAVIOUR

• Prefers to pay in instalments so that she can buy big ticket items

NEEDS

• Needs a way to know that she is borrowing money from a licensed moneylender

• Wants to find the moneylender with the best deal/ lowest interest rate

FRUSTRATIONS

• Unsure how to identify if moneylender is legitimate

• When money is being cheated

IDEATION

Wireframing & Prototyping

After picking out the insights from our research, we started off with an afternoon of brainstorming and bouncing ideas off each other. Samuel and I converged our ideas, had them sketched out on Procreate and prototyped on Figma.

We also came up with a design system to aid us in our project workflow. It was really helpful to have a design system in place as it not only saved time, but it also ensured consistency across the different screens. This ultimately allowed us to work concurrently and focus on addressing bigger problems.

.png)

TESTING

Usability Tests

After a quick rounds of rapid prototyping, we conducted 2 rounds of usability tests. We put 10 users to 3 tasks below and the results we got informed us on the strengths of our mobile app and also what needed to be iterated.

Task 1

Apply for a loan

"You require a loan of $1600 to pay off your bills, show us how will you apply for it."

Task 2

Check Loan Offers

"You've received a few loan offers, show us how you will view those loan offers."

Task 3

Inform Moneylenders of Repayment

"Show us how you will inform the moneylender that you have made repayments."

Usability Issue #1

Users had issues selecting the best loan offer

Analysis

Users felt that there was no clear comparison between different loan offers.

Solution

Organise and include important details of loan offers such as company's ratings, reviews, interest rate and tenure period to be visible on offers page all at one glance. Additionally, provide users with an option to sort the different orders according to their preferred order.

Tested by Participants

Revised Version

Usability Issue #2

Users were not entirely sure how the flow of loan application works

Analysis

We had steps to apply for a loan placed on moving banners, but users did not realise that they are steps on the loan process.

Solution

We revised the banner into a static header with steps of loan application process clearly stated.

Tested by Participants

.png)

Revised Version

Usability Issue #3

Users doubted the legitimacy of Loan Central as they were unaware that it is regulated by the government

Analysis

On hindsight, the approved government authority logos were easily overlooked by users as they were placed on the onboarding screens which users typically go through fairly quickly.

Solution

On top of the onboarding screens, we also included the government bodies logos on the home screen of the app to ensure that users will be aware that the the app is regulated by the government.

Tested by Participants

Revised Version

Usability Issue #4

Users were distracted by animations on both the confirmation and loan details pages

Analysis

Users felt that the animations were ineffective and communicated the wrong idea across to them. For example, the flashing tick gave users the impression that the submission was still ongoing and has yet to be completed. Whereas, the "jackpot" style of making the digits appear was simply unnecessary for borrowers who do not need the element of surprise.

Solution

Albeit the animations may have been visually appealing, we decided to remove them to prevent confusion to users.

Flashing tick animation

"Jackpot" style animation

DELIVER

The Final Design

We took the feedback gathered from our usability tests and iterated the design into this final mock up. Feel free to try it out!

Scan QR code to try prototype on your mobile

RETROSPECTIVE

Challenges & Opportunities

Challenges

Threading a thin line between insufficient information and information overload.

Creating and designing a finance app is by no means an easy job. One of the challenges I faced while doing this passion project was figuring out the right amount of information to keep users informed while avoiding disengagement.

We went down to one of the moneylenders' office to interview moneylenders and observe their interactions with borrowers. This was surprisingly insightful and from their conversations we found out what are the common questions borrowers ask or questions they are required to answer when borrowing money from licensed moneylenders.

This helped us decide what the necessary information needed on the app were. I would very much love to conduct more contextual inquiry for future projects.

Opportunities

We believe that there is great potential for the development of this app. Moving forward we hope to:

-

Focus on Security of the App - Cybersecurity is an essential focus of any business that has an online interface. With increasing public concern regarding information privacy, it is vital to work with experienced professionals from top application security testing companies for a thorough analysis.

-

Improving Accessibility - We want Loan Central to embrace inclusivity and would like to work on implementing adjustable font sizes, audio guidance and possibly dark mode for this mobile app.

-

Pitching the App - Loan Central has a business model and more importantly is able to help play a part in eradicating unlicensed moneylending in Singapore. Therefore, we would like to pitch this app to influential parties who are able to push the development forward and aid us in effecting the change needed in our society.